Your Tax Technology Firm

Your one-stop shop for specialty tax incentives and government stimulus programs.

We are firmly rooted in technology, enabling us to help our clients easily and compliantly unlock financial resources as we provide hands-on support throughout the entire relationship.

We call our customers our friends.

No need to take our word for it! Just a few of our five-star reviews.

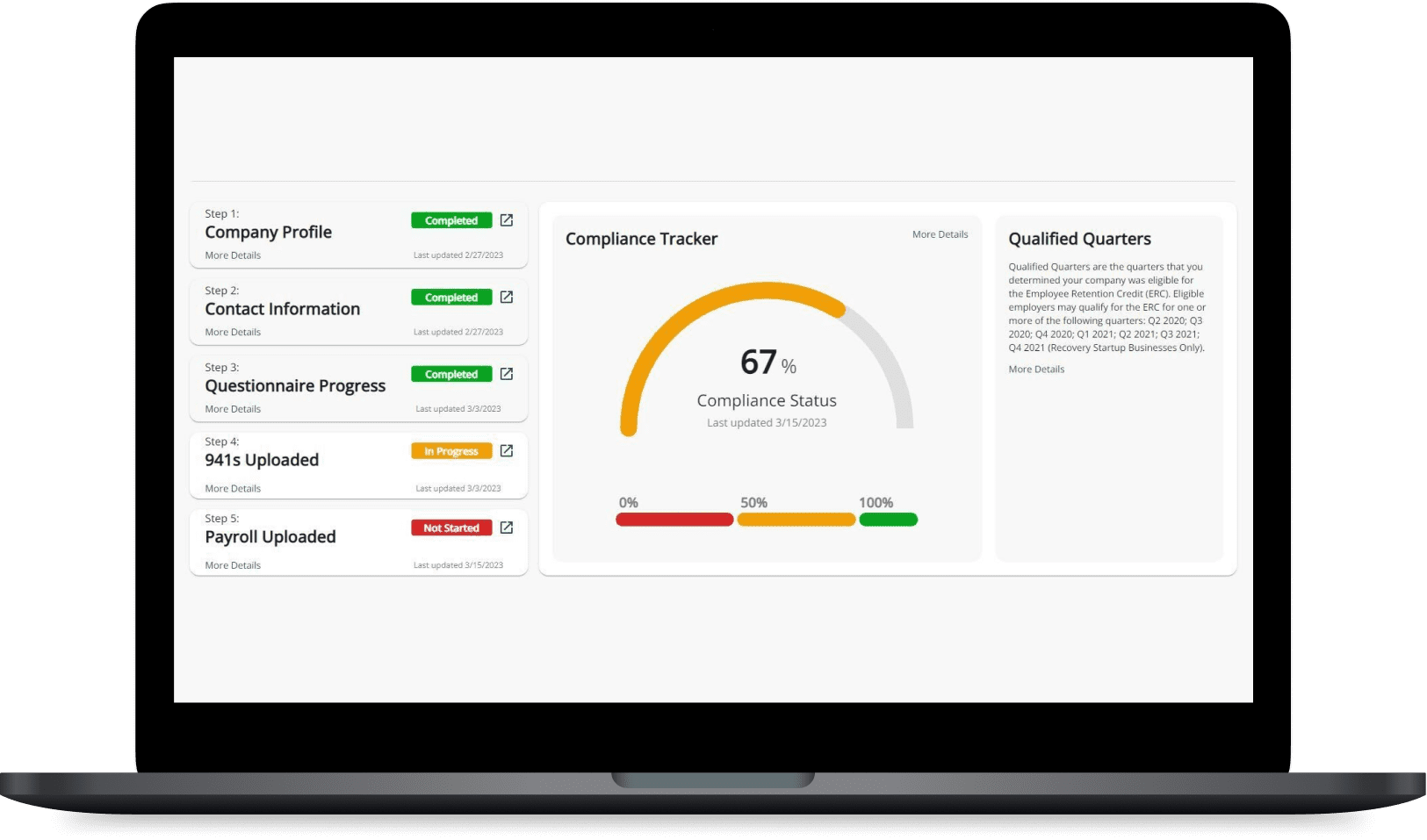

Compliance. Security. Peace of Mind.

Tax technology with 30+ years of combined experience

Built from the ground up as a tax technology firm, we’re focused on helping our clients with tax credits and government stimulus programs. The StenTam OS portal delivers a secure and easy to use platform for each of our clients.

We’re Ready When You Are.

It’s easy to learn if your business might qualify for tax credits or incentives. Schedule a no obligation consultation with one of our associates today.

Curious about how much your company may be missing out on accessing? We can help you understand if you qualify for any funds.

StenTam Highlights

Cost Segregation: A Tax Liability Reduction Tool for Owners of Short-Term Vacation Rentals

The vacation rental business is booming. There are an estimated 1.3 million such properties in the United States, with Airbnb and Booking.com leading the pack with the most listings. Although the U.S. only accounts for about 20 percent of the global vacation rental...

Form 7004: How You Can File for an Extension for Your Business Income Tax

Approximately 60 percent of Americans believe there are not enough hours in the day to complete their to-do list. Business owners are especially busy with responsibilities for building and maintaining operational and financial efficiency for their company. The...

An Illustrative Guide to Filling Out Form 1120

The number 1.5 million can be used to describe multiple things in the United States. For example, there are 1.5 million faculty at degree-granting postsecondary institutions in the U.S. Roughly 1.5 million Americans have lupus, and approximately that same number of...

Discover how Cost Segregation can maximize your tax benefits and increase cash flow for your real estate investments.

Fill in the form to begin.