The Research and Development (R&D) Tax Credit can be an excellent financial resource if your business is committed to innovating new or improved products, processes, technologies, or software. Unlike a tax deduction that reduces your taxable income, the R&D Credit is a dollar-for-dollar tax credit that allows businesses to directly reduce their tax liabilities. The R&D tax credit was introduced in 1981 as a temporary tax incentive under Section 41 of the Internal Revenue Code to drive investment in new technology. After several short-term legislative adjustments and extensions, the tax credit was permanently extended by the Protecting Americans from Tax Hikes (PATH) Act in 2015.

The R&D credit is available to any United States business that has engaged in domestic research activities, regardless of its size or industry. Per IRS guidelines, a qualified business must be engaged in the creation of a new business component or process, including improvements to an existing business component or process. The new process, product or service doesn’t have to be completely new; it just needs to be new to the business.

There are four criteria to determine whether your project is eligible for the tax R&D tax credit. That four-part test includes:

Permitted Purpose

The research and development must relate to either a new product or process or an improvement to an existing product or process. The research doesn’t have to pertain to something completely new to your industry. It can simply be an innovation for your company.

Elimination of Uncertainty

The research must seek to eliminate uncertainty with regard to the capability or method for developing or improving a product or service. This includes the appropriateness of a product’s design.

Process of Experimentation

The business must demonstrate that the research process includes testing hypotheses, evaluation of alternatives, and the process of discovery through trial and error.

Technological in Nature

The research must be based on the principles of hard sciences. Hard sciences can include biological science, computer science, physics, engineering, etc.

If your research project meets the four-part test, you may include certain related research expenses to support your R&D tax credit. These expenditures can include employee wages, the cost of supplies and materials for your research, as well as the cost of hiring independent contractors. While some employees may be engaged exclusively for research activities, other employees may be engaged only part of their time on qualifying research projects. For those employees, businesses will need to calculate how much of their time is spent engaged in research activities and only claim that percentage of the employee’s wages as a qualified research expenditure. Although contemporaneous records are best, the IRS may allow a reasonable estimate.

How Startups Can Qualify For the ERC

The R&D Tax Credit is available to any type of business. Startups often fail to claim the R&D credit due to a misunderstanding of this complex tax credit. One of the most common reasons why new businesses fail to pursue the R&D tax credit is because they paid little to no income tax and erroneously believe that the credit can only be applied toward their income tax. Fortunately, the IRS understands startups take a while to become profitable and allows new businesses to apply the R&D credit against their payroll taxes. Any unused R&D credit can be carried forward to future years.

To claim the R&D tax credit, you’ll need to complete IRS Form 6765, the Credit for Increasing Research Activities. This form is filed as part of your annual income tax return. If you’re a qualified small business and you plan on applying your R&D tax credit toward your payroll taxes, you will need to submit both Form 6765 and Form 8974, the Qualified Small Business Payroll Tax Credit for Increasing Research Activities. A Qualified Small Business is defined as a business with less than $5 million in average annual gross receipts and having gross receipts for no more than five years. This distinction is especially important for startups, who are likely to fall into this category.

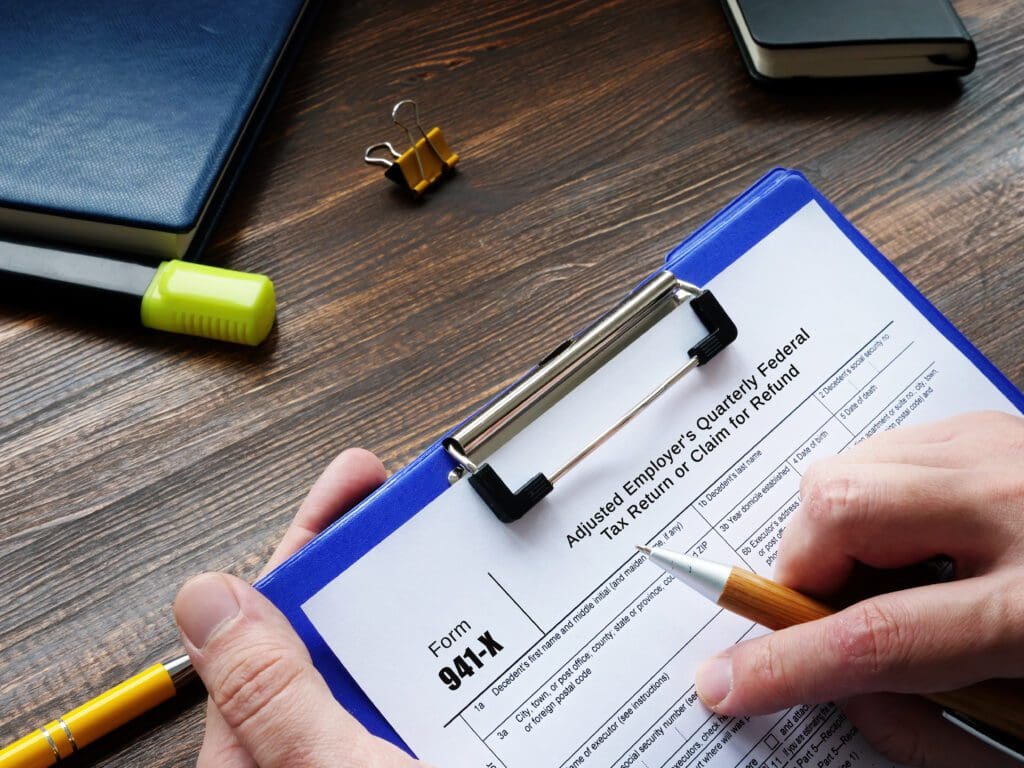

For business owners who could have qualified for the R&D tax credit but didn’t file, you’re in luck. You can file an amended income tax return up to three years after timely filing the period in question. If using the R&D credit to offset payroll taxes, you can file Form 941-X, which allows you to amend your previous payroll filing.

Why Is Working with Us the Best Way to Receive Your Credit?

In order to maximize your tax credit and ensure that your filing is fully compliant with IRS rules and regulations, it’s best to work with a qualified specialist. StenTam’s proprietary technology will determine the value of your tax credit down to the penny. Due to the complexities and unique nature of the R&D credit, it’s not uncommon for tax professionals to miss this opportunity for their clients. When you work with us, we can guide you through the process of claiming your credit and provide the documentation necessary to support your claim.

StenTam is committed to compliance with IRS guidelines. By making compliance a priority, we can minimize the potential for miscalculations or additional costs. With our compliance-first approach, you’ll receive full audit protection support to defend your claim, if scrutinized by the IRS or state tax authorities. In the event of an audit, our panel of outside legal and tax professionals will support your business.

Contact StenTam today to learn more about how to begin filing for R&D credits.