Defining the tax tech Approach

Our technology-enabled, compliance-focused solutions help clients maximize their tax credits and incentives, provide audit ready solutions and streamline the filing process.

StenTam by the Numbers

Industries Served

Years of Combined Experience

Tax, Legal & Technology Associates

Referral Partners

StemTam Covers All Your Tax Needs, All in One Place

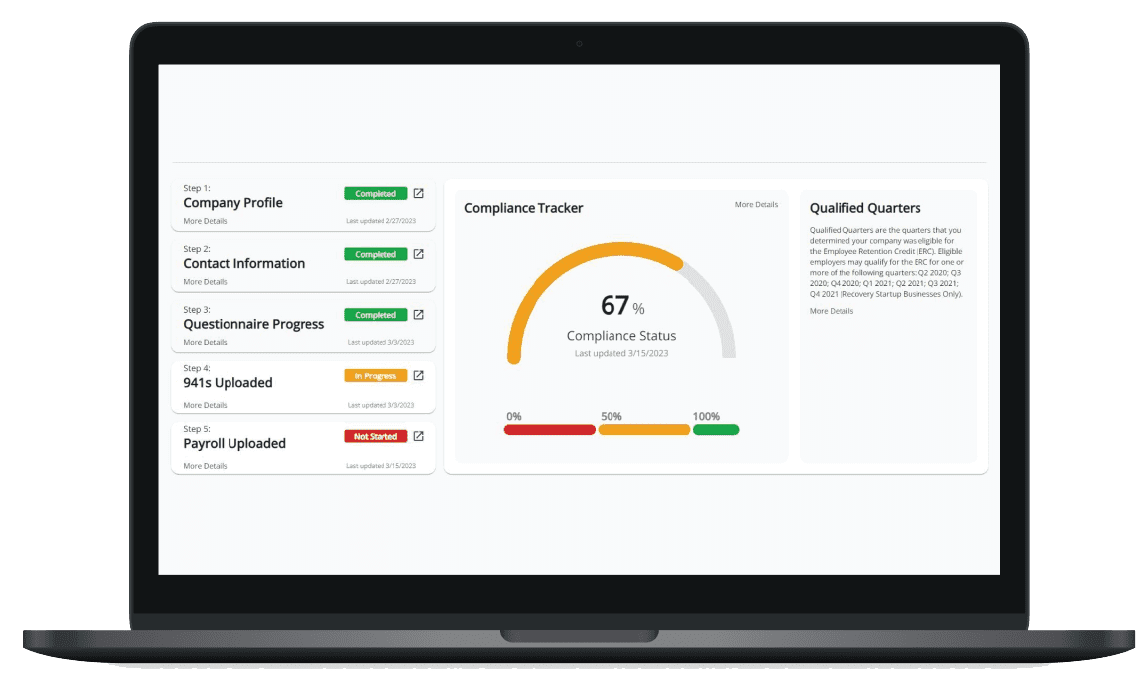

Compliance Portal

- Easy navigation, step by step process, you’ll always know where you’re at in your filing.

- Integrated Client Eligibility Questionnaire, ensures compliance with IRS program guidelines.

- Secure, protect your sensitive organizational information.

- Communicate directly with your CSM and securely share important documents.

Payroll Integrations

Payroll provider integration helps you upload the critical payroll files needed for accurate and compliant filing.

Automated Calculations

- Maximize your claim by reconciling out PPP payroll to determine eligible wages.

- Includes all data points specific to program guidelines.

- Produces complete and accurate amended return file.

- Mitigates potential audit risk due to inaccurate calculations.

Compliance Monitoring

StenTam monitors your claim from initial filing of the 941x though receipt of the 210 and your refund checks. Our compliance team calls the IRS every 30 days to check the status of your claim and we deliver support long after you’ve received your refund checks.

Technology Insights

Tax Advantages for S Corporations

More than 65 years ago, the United States Congress established S corporations to eliminate double taxation and encourage the creation of small businesses. Today, there are more than five million S corporations in the U.S. — three times the number of C corporations....

Corporate Tax vs. Income Tax for Businesses: A Detailed Guide

Taxes frustrate a lot of Americans, but the funds procured from them are utilized by the United States government to build, repair and maintain infrastructure, provide emergency disaster relief and fund numerous programs. Social Security, major national health...

Cost Segregation: A Tax Liability Reduction Tool for Owners of Short-Term Vacation Rentals

The vacation rental business is booming. There are an estimated 1.3 million such properties in the United States, with Airbnb and Booking.com leading the pack with the most listings. Although the U.S. only accounts for about 20 percent of the global vacation rental...

Discover how Cost Segregation can maximize your tax benefits and increase cash flow for your real estate investments.

Fill in the form to begin.