Businesses, small and large, were affected by the COVID-19 pandemic. Many had to resort to employee layoffs, while others shuttered completely.

The United States government implemented numerous initiatives to aid these businesses, including the Employee Retention Tax Credit. Introduced through the Coronavirus Aid, Relief and Economic Security Act (CARES Act), the refundable payroll tax credit was designed to encourage eligible employers to keep their employees on the payroll, even when they’re not working during the covered period due to the COVID-19 outbreak.

In March 2021, the Employee Retention Credit (ERC) was extended through the enactment of the American Rescue Plan Act (ARPA) to include all of 2021. Qualifying companies still have time to take advantage of the Employee Retention Credit and can claim 2020 expenses until April 15, 2024. Similarly, 2021 expenses can be claimed through April 15, 2025. How? By amending their quarterly tax returns through IRS Form 941-X.

In general, Form 941-X is used by employers to file either an adjusted employment tax return or a claim for a refund or abatement. If your business is eligible for the Employee Retention Credit, form 941-X can be used to file for the ERC retroactively as long as you submit it within the IRS’ deadlines. Navigating the process of amending Form 941-X can be confusing – just as with most tax forms! We’re here to guide you through that process.

What is Form 941-X? A Quick Glance

Basically, Form 941-X is utilized to make corrections to Form 941. An eligible employer is required to file Form 941-X for each calendar quarter in which they wish to claim the Employee Retention Credit. To complete the form, you’ll need to provide information on your federal income tax withholding, employment taxes, and Medicare taxes. You must submit Form 941-X within three years of the filing deadline for your previously filed Form 941.

How to Fill Out 941-X for Employee Retention Credit [in-depth Guide]

By following these instructions, you will be able to ensure that your Employee Retention Credit claim through Form 941-X is accurate and approved:

- Download Form 941-X from the Internal Revenue Service website.

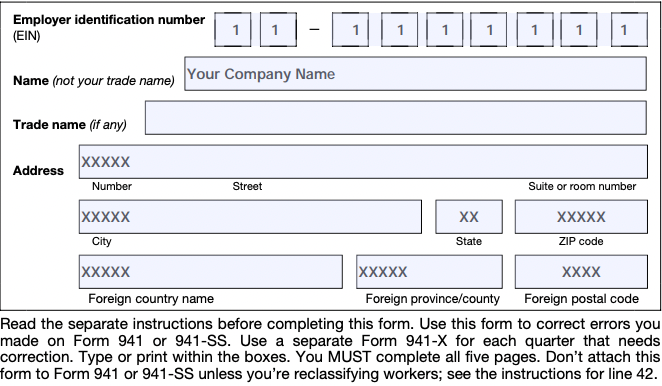

- Complete the company name and corresponding information on each page, including your Employee Identification Number.

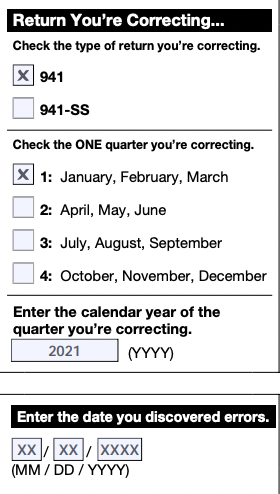

- Fill out the “Return You’re Correcting” section in the upper right corner of Form 941-X. Enter the calendar year of the quarter you’re correcting, and select the date you discovered errors in your Form 941.

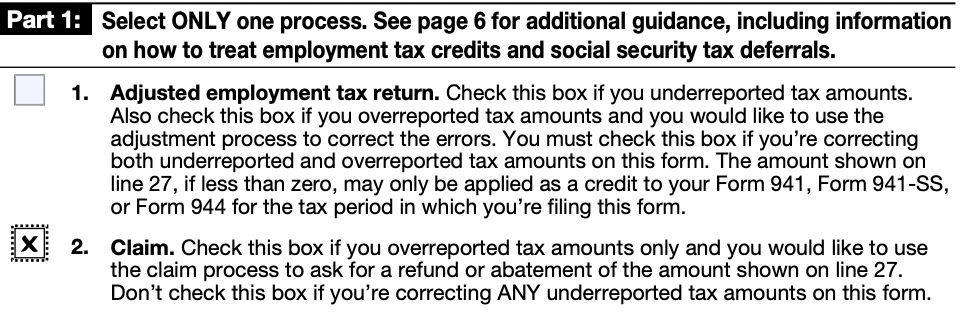

- Under Part 1, select whether you’re filing an updated job tax return (box #1) or a claim (box #2). In most cases, you’ll choose box #2.

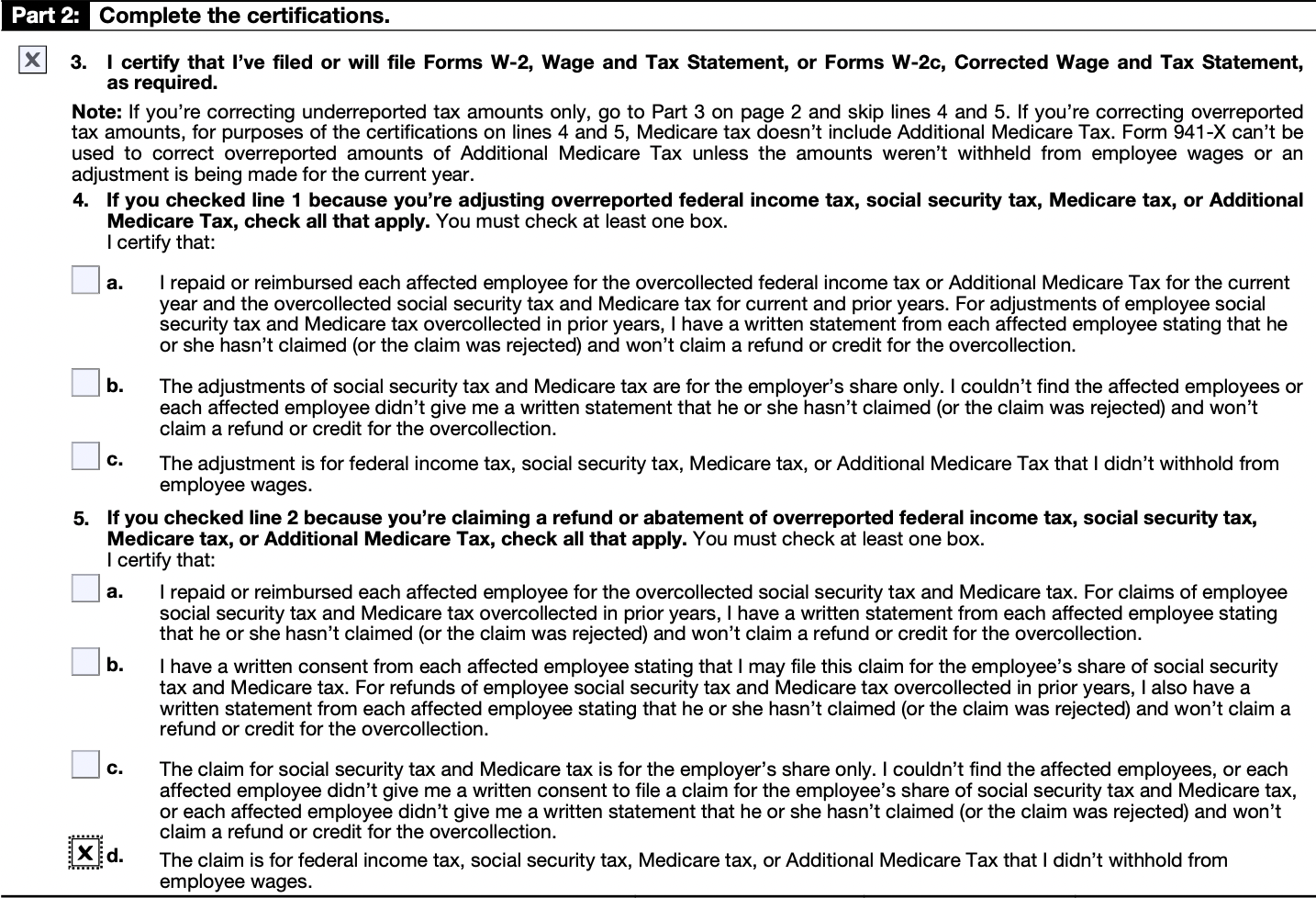

- Under Part 2, check box #3 to certify that you’re using the correct information for your analysis. Next, choose box #5d, which certifies that the claim is for the tax not withheld from the employee’s pay.

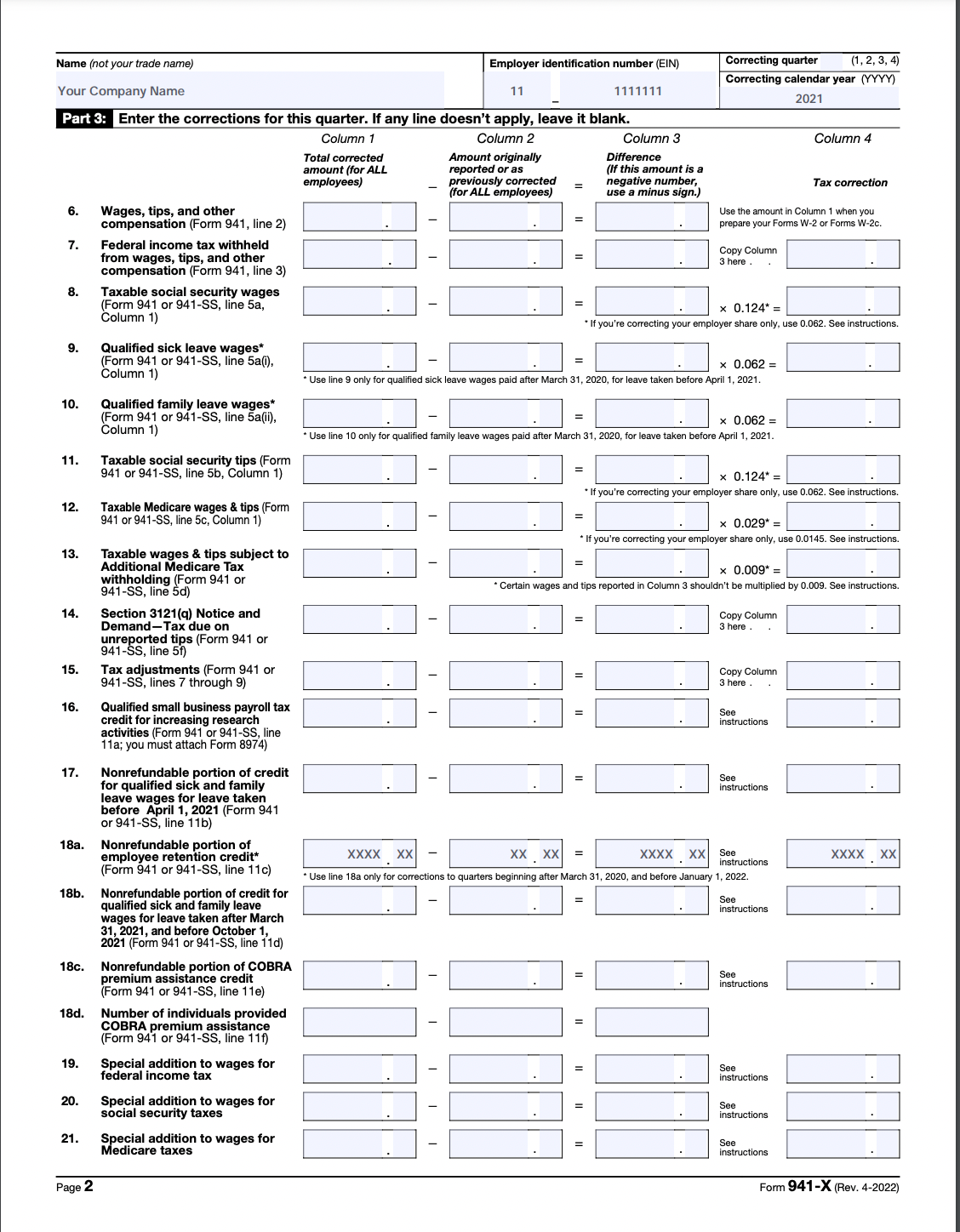

- On Page 2, Part 3, Line 18, enter your nonrefundable portion of Employee Retention Credit. The total amount of the ERC should be a negative number.

- Add the total from Lines 7 through 22 in Column 4, and record that number on Page 3, Part 3, Line 23.

- Enter your refundable share of the Employee Retention Credit on Page 3, Part 3, Line 26a.

- Combine amounts on lines 23 – 26c of column 4, and enter the total on Page 3, Part 3, Line 27.

- On Page 3, Part 3, Line 30, enter your qualified wages/revenue for the Employee Retention Credit.

- Leave Page 4 of Form 941-X blank.

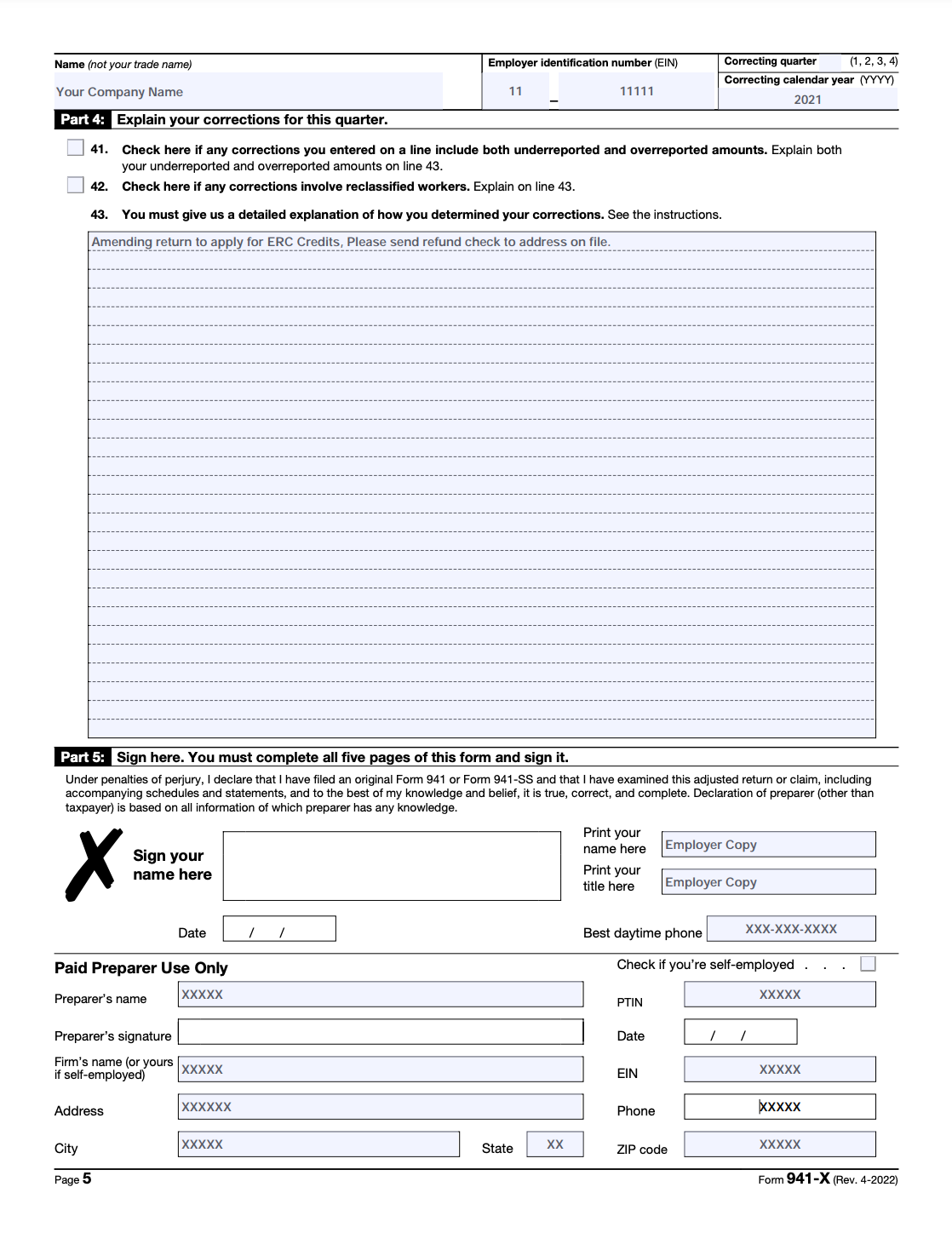

- Use Page 5, Part 4, Line 43 to explain in detail how you determined/calculated your credit amount. Consider using the Report paragraph on page 6 as guidance. Don’t forget to add your company mailing address.

- On Page 5, Part 5, sign the form where indicated.

- Submit your completed Form 941-X to the IRS.

Conclusion

If you are unsure about how to file a Form 941-X amendment for the ERC credit or need assistance preparing and submitting your application, consider working with one of our experienced tax professionals. Here at StenTam, our tax specialists can guide you through the process and answer any questions you may have along the way. We even have resources that enable you to track your refund. That way, you can feel confident about the accuracy and completeness of your amendment.

Get started with us today, so you don’t miss a cent! Also, check out our six tips for claiming the Employee Retention Credit.

FAQs

Is My Business Eligible for Employee Retention Tax Credits?

Under the CARES Act of 2020, businesses eligible for ERC credits include any employer operating a trade, business, or tax-exempt organization. However, it does not apply to governments or their agencies and instrumentalities.

Your business is eligible for the ERC if it sustained a full or partial suspension of operations limiting commerce, travel, or group meetings due to COVID-19 and orders from an appropriate governmental authority or experienced a significant decline in gross receipts during 2020 or the first three quarters of 2021. If your business qualified in the third or fourth quarters of 2021 as a recovery startup business, it also qualifies for the employee tax credit.

How Long Does It Take for Irs Form 941-x to Refund?

This varies by business, but backlogs at IRS submission processing centers have resulted in some businesses waiting 6-9 months for their ERC refund check. There are more than 800 various IRS tax forms and schedules.

What Documentation Do I Need for Form 941-x for My Employee Retention Credit?

Make sure you’re equipped with the following information:

- Complete payroll data

- Personal information (including Employer Identification Number)

- Prior years’ tax returns

- Copies of Form 941 filed for each qualifying quarter you plan to claim the ERC

How Do I Check the Status of My 941-x Refund?

Once you file the Employee Retention Credit using IRS Form 941-X, you should receive a notice from the IRS within four weeks detailing the status of your refund check. The Employee Retention Credit (ERC) refund typically takes 6-8 weeks to process.

To check on the status of your claim, call the IRS helpline at (800) 829-4933. Have your employer ID number, Social Security number and tax return information readily available.

What Are Qualified Wages Under the Employee Retention Tax Credit?

In general, ERC-qualified employee wages include those paid by qualifying companies to employees because operations were suspended or the business experienced a decline in gross receipts during the COVID-19 pandemic. What’s covered? Cash wages, both hourly and salaried, along with vacation pay and any other taxable wages. Wages under the ERC program also include qualified health plan expenses that are allocable to those wages.

Qualified wages paid under the ERC program are limited to the first $10,000 of compensation paid to any employee during a calendar year (2020) or calendar quarter (2021) and can be claimed for wages paid or incurred from March 13, 2020, through September 30, 2021. If your business employed an average of more than 100 full-time employees (generally 30 hours per week or more) on average per month people in 2019, you’re only able to claim qualifying wages for employees that you retained and paid for not providing services.